Price Waterhouse Coopers (PwC) is one of the largest accounting-multiservice firms in the world.

They produce business-oriented research that can be (sometimes) interesting.

PwC has teamed up with CB Insights to track VC investing in the USA.

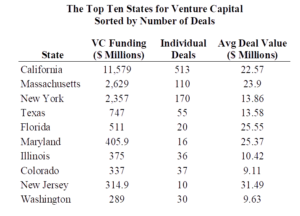

The result: Most of the investment in the USA is in only a handful of states.

It’s interesting to note that the PwC results vary somewhat from what is reported by the Hyde Park Angels, that I wrote about earlier. Differences are to be expected I suppose due to methodologies, completeness of the report etc. Though the general trends are the same.

According to PwC, during 2018 Q1 VC activity increased 4% to $21.1 billion. More than $11.5 of that was concentrated in California. This is to be expected, given the Silicon Valley metroplex investing scene. Though Los Angeles did pretty well with $1.9 billion.

The state of Massachusetts was second with $2.6 billion of VC investments. New York was third with $2.4 billion. Texas was fourth with $ billion.

For VC funding, the largest four states had more than $17.3 billion in financing.

Perhaps a little surprisingly, Northwestern USA had a total of $370 million. This includes Oregon, Idaho, Wyoming, Montana, and Washington state. What makes this surprising is that Washington (Seattle) is known for having a vibrant tech scene.

In the total USA, the average VC investment was worth $17.5 million. California deals were higher. Massachusetts, Florida, New Jersey, Maryland, and Oklahoma had larger deals.

The most common industry was the internet ($7 billion) followed by healthcare ($5.3 billion) and telecommunications was third ($3.5 billion).

Here is the chart.

I have been around the Chicago/Illinois tech scene for a long while. And have been doing business nationally for a long while too. I have consistently noticed a difference in innovation and innovation-oriented attitudes in the top four states listed in the chart, compared to the rest of the country. This is not just at the VC investors and CEO level, but permeates down even to entry level workers.

It’s something for business leaders and politicians to think about.